A.I. And Its Effects on Bookkeeping and Accounting

Bookkeeping is one of the most important aspects of a business and also one of the most time-consuming. A.I. is already changing different aspects of our lives, but how will it affect bookkeeping?

This article will look into different changes that could happen in the accounting and bookkeeping industry, and how A.I. will help make bookkeeping easier.

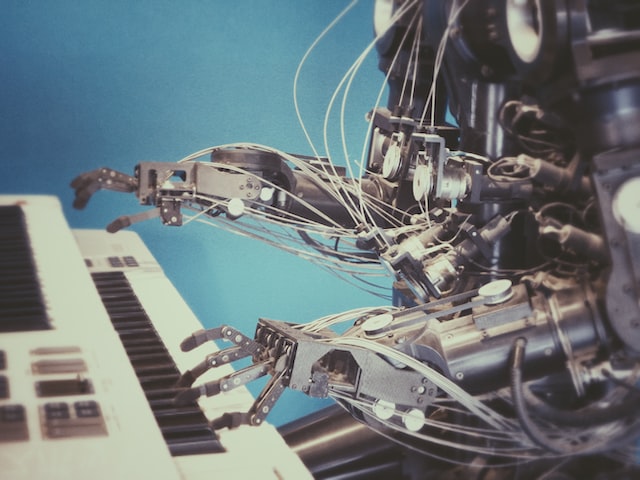

What is artificial intelligence?

In computer science, artificial intelligence (AI) is intelligence exhibited by machines, in contrast to the natural intelligence displayed by humans and other animals. AI research deals with the question of how to create computers that are capable of intelligent behavior.

In general, AI research aims to create computers that are:

• Capable of intelligent behavior

• Able to learn and work in complex environments

• Able to solve problems

Some common methods for creating AI include:

• Neural networks

• Genetic algorithms

• Reinforcement learning

AI research has found applications in a variety of domains, including:

• Natural language processing

• Robotics

• Computer vision

• Game playing

• Medical diagnosis

• Text mining

How artificial intelligence is changing the accounting and bookkeeping industry.

In the accounting and bookkeeping industry, artificial intelligence is being used to automate tasks such as bookkeeping, invoicing, and tax preparations.

Automated bookkeeping software can analyze data quickly and accurately, which can save accounting professionals time and money. AI-enabled invoicing software can create and send invoices quickly and easily, and AI-enabled tax preparation software can help accountants to find tax deductions and credits.

As a result, artificial intelligence is making the accounting and bookkeeping industry more efficient and cost-effective.

Who will benefit from automated bookkeeping?

The bookkeeping industry is ripe for automation. There are a number of companies who are offering software that automates various aspects of bookkeeping. This can include anything from tracking income and expenses to invoicing and payments.

Bookkeeping is a time-consuming and often tedious task. Automating this process can save business owners time and money. Here are some of the groups of people who can benefit from automated bookkeeping:

1. Business owners who are time- constrained.

2. Businesses who are looking to save money on bookkeeping costs.

3. Companies who want to improve their cash flow.

4. Those who want to focus on their core business.

Automated bookkeeping can benefit a wide range of businesses. It can help small businesses that are struggling to keep up with their bookkeeping duties. It can also help larger businesses that want to automate their bookkeeping process and improve their cash flow.

What are the risks of automated bookkeeping?

With the increasing popularity of automated bookkeeping, it is important to weigh the pros and cons to decide if this tool is the right choice for your business. Automated bookkeeping comes with a variety of risks that business owners need to be aware of.

The most obvious risk of automated bookkeeping is that the software can make mistakes. These mistakes can be costly, especially if they go undetected for a long time.

Another risk of automated bookkeeping is that it can be easy for someone to steal your financial information if your system is not password protected. If someone has access to your account, they could potentially siphon off money or even ruin your credit by making fraudulent charges.

Ultimately, the risks of automated bookkeeping depend on the specific software that you are using and how careful you are with your financial information. It is important to weigh the risks and benefits of automated bookkeeping before deciding if it is right for your business.

Conclusion

While artificial intelligence is making waves in a number of industries, it is also poised to make a significant impact on the field of bookkeeping.

As A.I. continues to get more sophisticated, it will be able to take on a wider variety of tasks and grow in importance in the field of bookkeeping and accounting. This is a trend that business owners and accounting professionals should be aware of and make plans for.